We are agile group of people.

Constantly focused on growth and beeing better

October 6, 2025

Fibonacci retracement (3853 → 3947) Harga di atas tiap level Buy zone: 3898–3885 🟩 SL: 3850 🟥 TP1: 3925 TP2: 3947 TP3: 3980 🎯 BRN: 3900 / 3950 […]

October 6, 2025

🧭 XAU/USD H1 – Fibonacci Projection (Modern Neon Edition) Format: JPG 1080×1080Tema: Dark mode dengan efek neon cyan–gold Detail Visual: xau/usd, #xau/usd stock, #xau/usd forex, #xau/usd […]

October 5, 2025

BTC/USD timeframe H4 menunjukkan reversal bearish setelah mencapai area sekitar 125K.Kita akan lakukan analisa Fibonacci retracement + menentukan entry, TP, dan SL berdasarkan struktur pasar. 📊 […]

October 5, 2025

📊 Fibonacci Retracement 109,400 → 125,367 Level Harga Label 0.0% 125,367 Swing High / HH 23.6% 121,800 Minor Support 38.2% 119,600 Entry Aggressive 50.0% 117,400 OTE […]

October 5, 2025

© 2025 Financial Market Company — All rights reserved. I. PENDAHULUAN Pembangunan infrastruktur jalan tol di Indonesia merupakan langkah strategis dalam memperkuat konektivitas nasional, menekan biaya […]

October 5, 2025

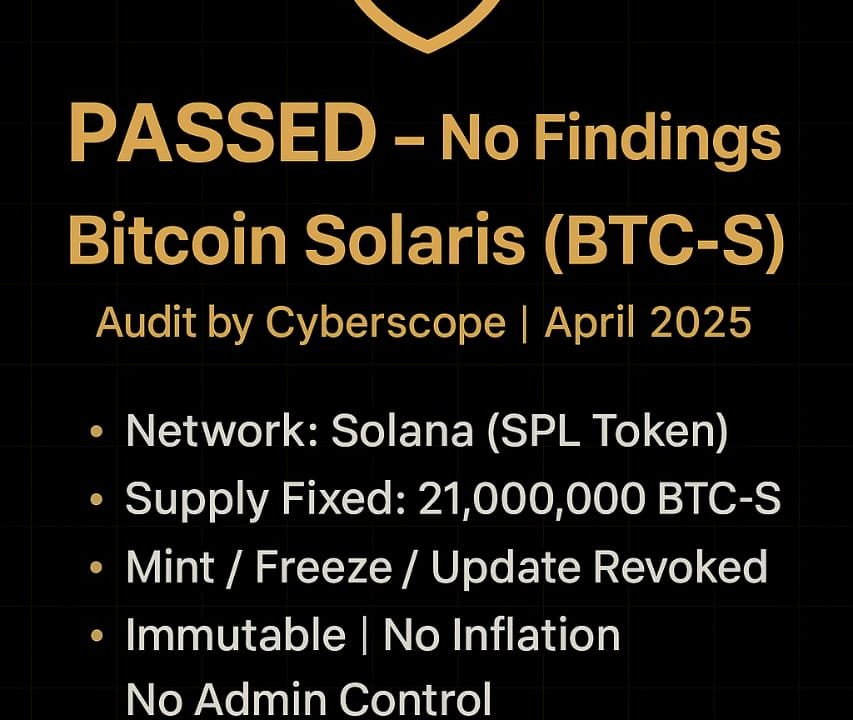

Audit Overview – Bitcoin Solaris (BTC-S) Auditor: CyberscopeTanggal audit: April 2025Jaringan: Solana (SPL Token Standard)Alamat kontrak: HjKkxYmvekKYo1WhWJivx5SeZxKP2vJ9CCZp9ZmvCCKqTotal Supply: 21,000,000 BTC-SExplorer: solscan.io 📊 Hasil Audit Keseluruhan Kategori […]

October 4, 2025

📐 Fibonacci Retracement Swing terbaru: Low 110.785 → High 123.408 👉 Discount OTE Buy Zone = 115.200 – 118.900 🎯 BUY Setup Plan 📌 Catatan bitcoin, […]

October 3, 2025

Harga sekarang sudah naik mendekati 3860 (TP1 yang kita set sebelumnya). Itu artinya harga sedang retracement up setelah sweep liquidity di bawah. 📊 Analisis Fibonacci & […]

October 2, 2025

Rencana Entry BUY (Discount OTE) Entry Zone (BUY OTE): 3835 – 3845 Stop Loss (SL): 3828 (di bawah SSL terdekat) Take Profit 1 (TP1): 3860 Take […]

October 2, 2025

Analisis H4 BTC/USDTrend: Bullish kuat, harga terus naik membentuk HH–HL. Kondisi sekarang: Harga di sekitar 118,300, dekat dengan resistance psikologis 120,000. Liquidity: Buyside liquidity ada di […]

October 2, 2025

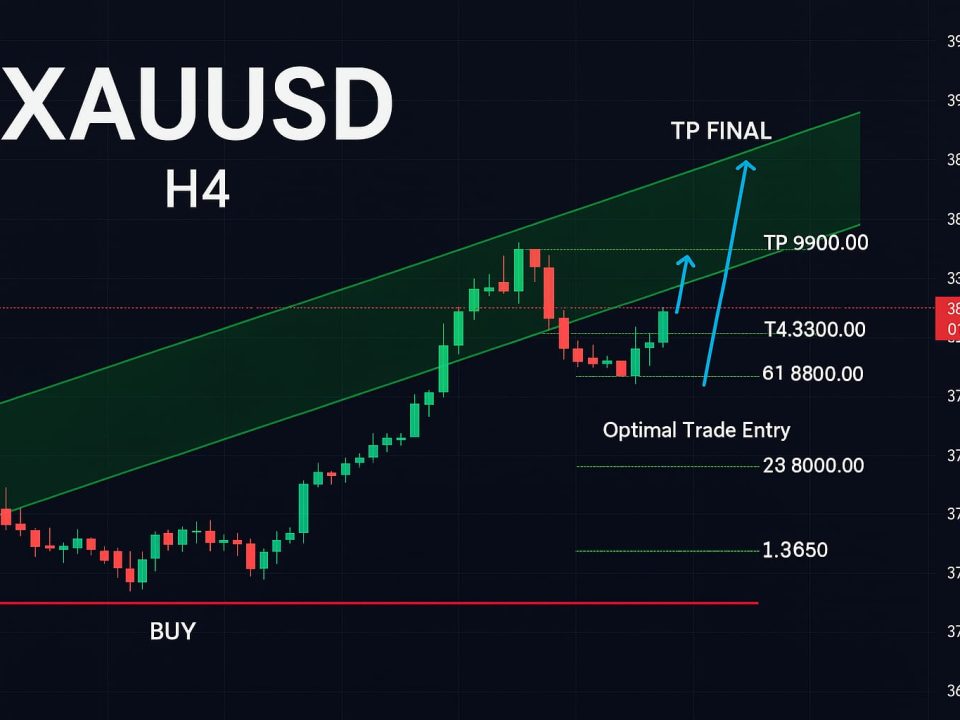

Analisis H4 XAUUSDTrend utama masih bullish (struktur HH–HL jelas). Harga sekarang di sekitar 3860–3870, reject dari atas channel hijau. Likuiditas atas (3895–3900 ATH) sudah disapu → […]

October 1, 2025

Analisis H4 Trend: Masih bullish jelas → struktur HH-HL konsisten. Kondisi Saat Ini: Harga menembus channel hijau (upper boundary) → indikasi breakout bullish, tapi area 3890–3900 […]