Prediksi chart XAU/USD 2 Oktober 2025

Prediksi XAU/USD sesi Amerika 1 Oktober 2025

October 1, 2025

Prediksi Chart BTC/USD 2 Oktober 2025

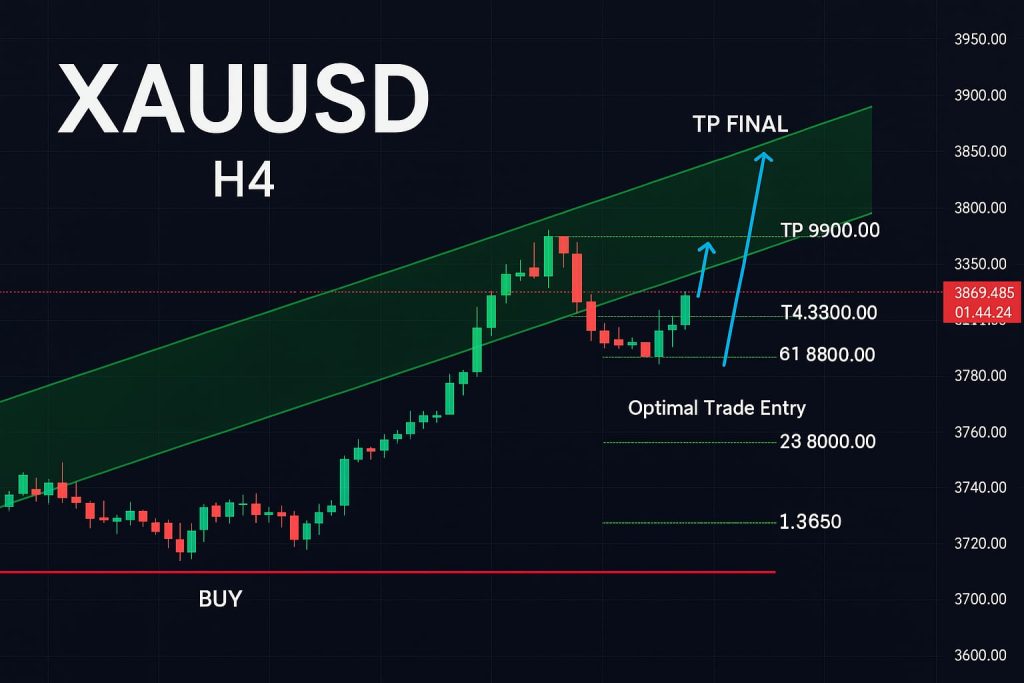

October 2, 2025Analisis H4 XAUUSD

Trend utama masih bullish (struktur HH–HL jelas).

Harga sekarang di sekitar 3860–3870, reject dari atas channel hijau.

Likuiditas atas (3895–3900 ATH) sudah disapu → wajar harga retrace lebih dalam.

Fibonacci Retracement (swing low → swing high)

0.236 ≈ 3870 (sudah disentuh).

0.382 ≈ 3840 → demand minor.

0.5 ≈ 3820 → retrace netral.

0.618 (OTE zone) ≈ 3805 → area buy ideal.

0.79 ≈ 3785 → invalidation terakhir.

⚡ Entry Buy (Fibonacci H4)

Entry Buy 1: 3840 – 3820 (zona 38.2–50%).

Entry Buy 2 (Optimal): 3820 – 3805 (61.8% OTE).

SL: 3785 (di bawah swing low & invalidation).

TP1: 3890 (retest resistance minor).

TP2: 3920.

TP FINAL: 3950 (expansion target berikutnya).

Probabilitas: ~72% (konfluensi bullish structure + FVG retrace + OTE Fibonacci).

📅 Awareness

Sesi NY + news USD bisa trigger spike turun ke OTE (3805–3820) sebelum rally.

Jika H4 close < 3785 → bullish invalid → siap switch ke short.

👉 Ringkasan:

Buy terbaik di 3820–3805 (OTE zone H4), SL 3785, target ke 3890 → 3920 → 3950

xau/usd, #xau/usd stock, #xau/usd forex, #xau/usd technical analysis, #xau/usd live chart, #xau/usd investing, #xau/usd historical data, #xau/usd live, #xau/usd all time high, #xau/usd analysis today